Silver Is The Key

The manipulation of our money is coming to an end.

Did you catch Trump’s Truth Social post the other day that was threatening the BRICS nations?

Here’s what Trump said:

The idea that the BRICS Countries are trying to move away from the Dollar, while we stand by and watch, is OVER. We are going to require a commitment from these seemingly hostile Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy. They can go find another sucker Nation. There is no chance that BRICS will replace the U.S. Dollar in International Trade, or anywhere else, and any Country that tries should say hello to Tariffs, and goodbye to America!

Was it signal?

Does Trump really want to maintain the current global financial system, which is completely centralized around the dollar?

Does Trump really want to continue to force other countries to use the dollar in order to conduct trade, especially for critical commodities such as oil?

Forcing countries to hold dollars in reserve for vital trade, takes away other countries sovereignty.

Does Trump want to keep everyone dependent on the U.S. dollar, and continue to use threats to force compliance, similar to the centralized debt system the world is currently trapped in?

I don’t think so.

I think Trump wants to completely set the world free from financial tyranny.

Remember, this is war against a cabal who have controlled the global financial debt system for generations and Trump is bringing this cabal control to an end.

Deception is required in war.

It has been my opinion for years, that Trump is actually working with the BRICS nations to create their competing financial system, which removes centralization and PROTECTS every country’s SOVEREIGNTY. Their financial system uses a basket of commodities in order to back up their coming stablecoin for international trade. They would still control their country’s currency. They would no longer be required to hold another country’s currency in order to buy oil or anything else.

Freedom within an honest and transparent system that sets an even playing field for all countries.

I think that’s what Trump has been fighting for from the beginning.

Trump said in his TS post, that they are “seemingly” hostile countries.

This is signal.

This TS post is for normies because they still don’t know who the real enemy is.

Trump is actually allied with these very nations who created the BRICS system.

Both Putin and Xi, along with MBS are working with Trump to remove the cabal control.

I give the evidence for why I believe they are allies, in these two articles from about two years ago.

I actually think this Trump post is signal to his allies that the events that are going to change the entire financial system are incoming. It might even be a signal for them to take their next step.

But this wasn’t the only signal that caught my eye recently.

I think there was another HUGE signal that Trump gave, which also points to this incoming transformation of the world’s financial system.

Did you hear what Trump said at the Davos meeting with the world’s biggest financial players?

He specifically called out Brian Moynihan, the CEO of Bank of America and Jamie Dimon, the CEO of JPM.

He called them out for de-banking conservatives.

I found it very interesting that he called those two banks out in front of the world’s big financial players.

Why?

Because I know something about those two banks that reveals a major weakness for the cabal’s control of the world’s financial system.

Was Trump pointing them out to the cabal because he knows their weakness too?

I’m thinking that’s exactly what he did.

Back in 2022, something huge was revealed in a government report. Bank of America had made major changes and it was deeply connected to JPM.

Have you seen this story?

According to SilverSeek.com:

https://silverseek.com/article/another-stunning-occ-report-0

The new Office of the Comptroller of the Currency’s Quarterly Derivatives Report was just released for positions held as of Dec 31, 2021. The report covers Over-The-Counter derivatives positions, including precious metals derivatives held by US banks, meaning that the listed futures and options contracts on the COMEX are not included in this report. Unlike the COT report, which never identifies traders by name, the OCC report does name the top four US banks in each category (where applicable). The OCC report for precious metals only includes positions in silver, platinum and palladium.

“The new OCC report is stunning for a number of reasons. One, it indicates another sharp increase in the precious metals’ derivatives holdings of Bank of America. In addition, the total amount of precious metals derivatives held by all US banks reached record levels, despite prices not being at record levels. Perhaps most notable of all is that the current report indicates a remarkable change in the composition of holdings by the four largest US banks.

Previously, JPMorgan dominated the precious metals derivatives holdings over the years, often holding as much as 80% of the total holdings of the 4 largest banks. The new report indicates that JPM’s share of the 4 largest banks’ precious metals derivatives holdings is down to 42% and Bank of America holds close to the same total share as JPM. This represents an unprecedented reduction of JPMorgan’s former dominant role in OTC precious metals derivatives.

The new report, for positions held as of Dec 31, 2021, indicates an even larger increase in Bank of America’s precious metals derivatives position than over the prior quarter of just over $9 billion, to $27.32 billion. JPMorgan’s total of $28.2 billion was only half a billion dollars higher than the previous quarter, largely a reflection of the slightly higher silver price.”

For years, JPM was by far, the biggest holder of precious metals derivatives. Starting in 2022, BOA began taking hold of an equal portion of those derivatives, making them the two biggest holders.

Why?

I believe Jamie Dimon was really worried about the precarious position his bank held as the ultimate controller and manipulator of precious metals, especially SILVER.

More from SilverSeek:

One of the most shocking features of the new report is that Bank of America is now within a whisker of becoming the largest US bank precious metals derivatives holder from, quite literally, holding zero precious metals derivatives positions as recently as two and a half years ago. In fact, over the 24 months from Dec 31, 2019, BofA’s OTC precious metals derivatives position has increased by an astounding 185 times or 18,500%, from $148 million to $27.32 billion. In terms of such an extremely large increase in any derivatives category, there has never been anything like this in OCC reporting history.

Why was BOA suddenly taking on half of these precious metals derivatives?

There’s a good reason and it happened in Trump’s first term.

According to CNBC:

https://www.cnbc.com/2020/09/23/jpmorgan-to-pay-almost-1-billion-fine-to-resolve-us-investigation-into-trading-practices.html

JPMorgan Chase is close to paying almost $1 billion to resolve government investigations into the alleged manipulation of metal and Treasurys markets, according to a person with knowledge of the matter.

A settlement between New York-based JPMorgan and several U.S. agencies could come as soon as this week, according to Bloomberg, which first reported news of the fine. The deal would resolve probes from the Justice Department, the Commodity Futures Trading Commission and the Securities and Exchange Commission.

A penalty of that size would be a record for spoofing, which is when sophisticated traders flood markets with orders that they have no intention of actually executing. The practice was banned after the 2008 financial crisis and regulators have made it a priority to stamp out.

JPM got caught manipulating the precious metals market in order to manipulate Treasury’s. Their metals trading desk was “spoofing” precious metals traded, especially silver, in order to suppress the price. Spoofing is the act of trading with no intention of actually taking delivery of the silver. It’s paper trading for the sole purpose of manipulating the price.

More from CNBC:

The case was revealed in September 2019 when a 14-count criminal indictment against three current or former JPMorgan employees, including the global head of base and precious metals trading, was unsealed.

The indictment alleges the traders, along with eight unnamed co-conspirators who worked at JPMorgan offices in New York, London and Singapore, participated in a racketeering conspiracy in connection with a multiyear scheme to manipulate the precious metals markets and defraud customers.

This prosecution started in September of 2019.

That’s an important data point.

They were basically trading between the three JPM offices in New York, London and Singapore and it was completely fraudulent. No silver ever changed hands.

The people involved got prosecuted and convicted. JPM was put on notice. I believe that’s why JPM began to divulge about half of their metals derivatives business to BOA, starting in December of 2019.

But that didn’t change the manipulation of silver and by extension, gold.

Here’s another article from SilverSeek from 2021 that spells out what the new scam was.

According to SilverSeek.com:

https://silverseek.com/article/new-piece-puzzle

One constant in these quarterly reports is that JPMorgan has dominated OTC dealings in every category for as long as I can remember, including precious metals. However, the new report indicates that BankAmerica has now emerged as a major participant in precious metals OTC derivatives. BankAmerica’s position of $8.3 billion (as of Dec 31), has, essentially, come into existence since March 31, 2020, when it was under $175 million. What would account for the tremendous growth in BankAmerica’s OTC derivatives positions from March 31, 2020 to December 31, 2020?

BOA began taking on a huge amount of metals derivatives in early 2020, after JPM had got caught manipulating prices.

While this was happening, something big changed. This change will reveal something huge.

More from SilverSeek:

One highly unusual development in 2020, was the unprecedented increase in physical holdings in the silver ETFs. Close to 300 million ounces came into the silver ETFs, starting around April 1 into the summer. In trying to explain where the physical silver was coming from at that time, I suggested that it was coming from JPMorgan in the form of a physical silver lease to other banks. The time line indicated in the OCC reports does point to my leasing premise. At the prices at year end ($26.50), $8.3 billion worth of precious metals derivatives would come to just over 300 million ounces.

Don’t miss the timeline.

JPM’s top metal traders got indicted in September of 2019. BOA then begins to become a player in the metals derivatives market in December of 2019. By March of 2020, BOA has already become a major player in metals derivatives. Then on April 1, 2020, there was an unprecedented increase in the “physical holdings” in the SILVER ETF’s. JPM was the biggest holder of physical silver in the world at that time. They were leasing SILVER to other banks who were then selling that silver to ETF’s.

Guess which bank?

More from SilverSeek:

As to why BankAmerica would engage in such an apparently foolhardy venture of borrowing 300 million oz of physical silver with the promise of having to return it someday, you have to first understand the nuttiness of precious metals leasing. Someone with the physical silver (JPMorgan in this case) relinquishes the metal to an institution (BankAmerica). Aside from the promise of the physical return of the metal, JPMorgan also gets rental income. BankAmerica, not wishing to simply hold the metal because there’s no real purpose in doing so, turns around and sells the metal to a completely independent third party, in this case the silver ETFs, who’s investors pay cash money for the free and clear title to the metal. BankAmerica gets the full use of the cash ($8.3 billion) to do with as it pleases.

This is the new scam in order to manipulate the SILVER price and by extension, the gold price.

JPM leases 300 million ounces to BOA for a fee with the promise to return it in the future. That PROMISE to return the silver is a big deal.

After BOA leased the silver, they then sold it to the silver ETF because the ETF is holding the silver for those investors who purchase the silver ETF’s shares. Those investors legally hold the title to that physical silver that the ETF holds in their name.

Sounds like a great deal for everyone, right?

Not so fast.

More from SilverSeek:

If silver goes down in price or stays the same, no big deal for BankAmerica, provided it can buy the physical silver back on the open market whenever it decides to. However, if silver prices rise sharply and it’s not so easy to buy back 300 million physical ounces, then BankAmerica has a problem. Twenty years ago, Barrick Gold and AngloGold had the same problem with gold leases and lost $10 billion each. If BankAmerica did borrow and sell the metal to the silver ETFs, as appears to be the case, it is now short 300 million ounces of physical silver, which is a heck of lot worse than being short 60,000 contracts of COMEX futures. It has to be that JPMorgan bamboozled BankAmerica in this transaction.

BOA sold the silver they were leasing from JPM to an ETF. BOA will have to “purchase” silver on the “open market” at some point in order to return it to JPM. As long as the silver price isn’t higher than the price they sold it to the ETF, then they make money. The problem is, silver is much higher right now. A lot higher. They are in the hole already and it’s getting worse.

More from SilverSeek:

BankAmerica didn’t suddenly wake up one day and decide to borrow and sell (short) 300 million ounces of physical silver. It’s much more likely that JPMorgan dreamed up the whole affair, since it and its related entities will profit mightily as a result. The net result of all this lending, borrowing, selling and buying of 300 million ounces, is that the friends and family of JPM now own at least 1.2 billion ounces or 60% of the world’s 2 billion ounces of total world silver inventories. BankAmerica is now obligated to return 300 million ounces of physical silver to JPM someday. BofA is already in the hole for $2 billion since it borrowed the 300 million ounces at an average price of $18 or less and is already $7 underwater. At some point BofA will wake up (if it has not already awakened) and try to buy back its excessive and decidedly unprofitable silver short position. That attempt by BankAmerica will prove to be exceedingly bullish for the price of silver.

This article was written in 2021. BOA borrowed 300 million ounces of silver at an average price of $18 and they were already down $2 billion because the silver price had rose to $25. But now the price is around $32. They are down billions more.

I disagree with the author that JPM took advantage of BOA and tricked them into this horrible deal. I think this was all planned after JPM’s metal desk got indicted. They needed a “new way” to manipulate the price that was no longer “in house.” They now share that responsibility with BOA. ETF’s are another easy way to manipulate the prices because the physical metals don’t actually get delivered to the shareholders.

They were now using the ETF to manipulate the price. The silver ETF has to buy or sell their physical silver when there shares are either bought or sold.

JPM still held the largest amount of physical silver in the world and could sell their silver to keep the price suppressed. As long as nobody really wanted silver, they could continue to manipulate the price and thus, put a cap on the price of gold and prop up the fiat dollar.

But BOA was short 300 million ounces of silver and down billions of dollars.

The biggest danger for both JPM and BOA is a rising price in silver. It is also the biggest danger for the worldwide fiat debt system. JPM owning the most physical silver in the world protects them from a spike in the silver price but it doesn’t protect BOA.

Why?

More from SilverSeek:

While I’ve confined my remarks today to the 300 million ounces that BofA borrowed and sold short last year, there is another 100 million ounces borrowed and sold short since the start of this year and all told, I would estimate that at least 400 to 500 million ounces of silver have been borrowed and sold short in total. This amount of shorted silver is completely distinct and separate from the formidable concentrated short position in COMEX silver futures. It is the combination of these two separate short positions, currently totaling as much as 850 million ounces that explains the otherwise inexplicable insanely low price of silver. Furthermore, that much silver could never have been bought in the open market without launching the price to the heavens.

BOA isn’t the only big bank that is shorting silver in order to suppress the price. There are massive amounts of silver short derivatives. At least 850 million ounces of silver.

COMEX, short for the Commodity Exchange, is a division of the CME Group and is one of the primary futures and options exchanges for trading precious metals like gold and silver. COMEX is known for its high liquidity, with over 400,000 futures and options contracts executed daily. It is the central hub for futures and options trading of precious metals.

Unlike the gold exchange in London, the vast majority of COMEX contracts are settled without actual delivery of the silver or gold. That’s a key point and the major way that silver has been manipulated.

The JPM metals traders who were convicted in 2019 for “spoofing” metals contracts on COMEX, never intended on delivering any metals they traded. They were phony trades used to manipulate the price.

But how did JPM get ahold of the biggest physical silver supply in the world?

Do you remember the 2008 financial crisis?

It was a massive Ponzi scheme centered around real estate and big banks were caught holding derivatives for a lot of underwater mortgages. It collapsed the entire world’s financial system and caused a panic in the markets.

But do you know what actually “triggered” the financial collapse?

Was it mortgage defaults, or was it something else?

What popped the housing bubble in 2008?

Was it the Lehman Brothers collapse?

Do you remember which big investment bank went bankrupt before Lehman Brothers and why they went bankrupt?

From another article by SilverSeek.com:

https://silverseek.com/article/bear-stearns-different-opinion

The general theme is that Bear Stearns failed because of mortgage securities gone bad and that JPMorgan, had it realized the enormous legal fees and fines it would be forced to pay as a result of the takeover, would not do so again. Like many, I was transfixed by the daily events that led up to that fateful weekend in 2008 when Bear’s failure and JPMorgan’s acquisition occurred. About the very last thing on my mind at the time was any direct connection with silver or gold. It would be months before I came to realize that JPMorgan’s takeover of Bear Stearns would be the most important development in the modern history of silver.

Bear Stearns failed BEFORE Lehman Brothers and everyone assumed it was because of bad mortgage securities.

But JPM stepped up and acquired Bear Stearns in order to prevent their bankruptcy. Bear Stearns was just the first domino of “big bank” failures. The narrative has always been that JPM was trying to prevent the financial collapse by taking over Bear Stearns.

What did this acquisition have to do with silver?

More from SilverSeek:

To this day, I have never seen any mainstream media article even mention silver and gold in connection with the takeover of Bear Stearns, and after ten years I wouldn’t expect that to change. Never mind that Bear Stearns failure coincided, to the day, with gold hitting all-time highs (over $1000) and silver hitting 30 year highs ($21). Even though it’s easy to calculate that Bear lost more than $2 billion in being short gold and silver from yearend 2007 to mid-March 2008, never is that fact mentioned in any mainstream account.

The trigger that caused Bear Stearns to go broke, was the spike in gold and silver in March of 2008. Bear Stearns was shorting a lot of gold and silver. That trade went really bad and triggered the investment bank’s collapse. It happened within a few months because of the spike in silver.

So how did this bank collapse become “the most important development in the modern history of silver?”

More from SilverSeek:

Since Bear Stearns was classified at the time as an investment bank, not a commercial bank, it’s massive short positions in COMEX silver and gold were never included in the Bank Participation Report and I had no idea that it was the big short seller (same with AIG Trading which was the largest short seller before Bear Stearns). Of course, I knew there was an unusually large concentrated short position in COMEX silver for many years, but I could only guess at who the biggest short might be. But all that changed when JPMorgan took over Bear Stearns, although I would have to wait until the Bank Participation Report of August 2008 and the subsequent letters from the CFTC to various lawmakers confirmed it was JPMorgan who was now the big silver crook and manipulator.

Nobody knew that Bear Stearns was the big bank that was shorting silver and gold. The reason nobody knew was because an investment bank didn’t need to report it on the Bank Participation Report.

So JPM wasn’t trying to be the “good guy” by saving Bear Stearns in order to prevent a financial collapse. The financial collapse was inevitable. They all knew it was coming.

JPM bought Bear Stearns so that they could become the biggest silver manipulator in the world. It gave them control of the silver price which helps them also manipulate the gold price because they are linked. They are both safe haven assets it financial times of trouble.

If you don’t understand how important this link between gold and silver is, there is a major story that most people know nothing about, but represents the red light flashing in the dashboard warning for what is about to happen.

According to Vongreyerz Gold:

https://vongreyerz.gold/comex-flows-is-the-gold-case-almost-too-obvious

For years, we’ve been warning of gold’s critical role as a buffer against increasingly obvious currency risk, banking risk, geopolitical risk and market risk.

And for years, we’ve been warning about the precious metal price fix in the COMEX, the hidden risks of holding physical gold in a commercial bank, and the now irrevocable de-dollarization trend away from an indebted UST and weaponized greenback.

Since the November Trump Victory, over 400 Metric tons of physical gold has left London for the NY COMEX warehouses.

This has resulted in a 75% increase of the COMEX gold stockpile (29.8M ounces, or 926 tons).

Why the big move?

As aways, the Main Stream Media (MSM) can be counted on to give the wrong but eloquent answers to an otherwise obvious currency breakdown (and gold directional move) hiding in plain sight.

The headlines partially ascribe the massive gold flow to fears of future tariffs on gold imports.

They point as well to a potential arbitrage play between the UK gold spot price and the NY-based futures price (London is known for making the physical gold spot price; NY is known for the futures contracts).

Our view, footnoted by years of tracking, warning and describing the real smoke behind the COMEX fire, is a bit more blunt, a bit more foreseeable and, well, a bit more tragic.

Since Trump’s victory, a record amount of gold has left London for the COMEX warehouses in New York. And it’s not slowing down. The stockpile of gold has increased by 75% in that short amount of time and January saw one of the biggest increases ever. Almost all the media stories say that it is related to Trump’s threats of tariffs, but that has nothing to do with it.

What’s the real reason that massive amounts of gold are flowing to the COMEX in New York?

More from Vongreyerz Gold:

As we wrote in 2021, the post-Basel III banks were going to need more allocated/physical gold to comply with Basel Regs.

This presented a clear and present danger to the ongoing and legalized price fixing of COMEX gold by a handful of bullion and TBTF banks.

These banks maintained a permanent levered short on the gold price via daily (and massively levered) short contracts against gold (these contracts were typically backed by 4% actual gold and 96% paper leverage).

This is really important to understand. Something huge happened during Trump’s first term and I think he was the one behind it. Gold was reclassified as a Tier 1 asset under the Basel III regulatory framework, which took effect on March 29, 2019. Once again, gold became money.

How did that change futures trading on COMEX?

More from Vongreyerz Gold:

For decades, the COMEX could play this short game because gold on the COMEX stayed on the COMEX, as nearly every futures contract was simply rolled over (an institutionally accepted game of extend and pretend) rather than “standing for physical delivery.”

In short, the physical gold (collateral for the perma-short) never left the building but just stuck around for the omnipresent, 8:30 AM price fix.

Can you see how this game has been played for many decades?

London was the Rothschilds gold hub, where they held a large portion of the physical gold and they were in control of setting the physical price. The coordinated 8:30 am price fix.

But COMEX in New York, is where the precious metals futures would be traded and the physical metals rarely changed hands. They were mostly traded on paper and highly leveraged. That started to change after the Basel III regulations made gold a tier one asset.

But then things massively changed as soon as Trump won his second term.

More from Vongreyerz Gold:

The COMEX Uh-Oh Moment?

BUT NOW THE GAME HAS CHANGED. Players on the COMEX are no longer rolling over their contracts but asking for PHYSICAL DELIVERY of the gold (this is called “Open Interest”, and it’s up 750%).

Traders on COMEX are now demanding the physical gold. It’s up 750%. That is a massive change. Paper gold is not real gold. Suddenly there is a panic in taking possession of this critical tier one asset.

Why is this happening?

More from Vongreyerz Gold:

But why are traders, nation-states and central banks suddenly seeking physical gold delivery?

We saw De Gaulle do it in 1971. We saw the Germans do it in 2016. India and China have been doing it off the radar as well.

In fact, we’ve been warning of (and answering) this question for years.

And the answer is simple: In times of crisis, the world trusts physical (indestructible) gold far more than paper money, digital coins or Uncle Sam’s IOUs.

Let this be a history lesson.

Gold has been a safe haven asset for 5000 years. Nothing has changed. It is still the most important safe haven in times of financial crisis. It is real money and a tier one asset once again.

Why did the U.S. go off the gold standard in 1971? We were fighting a war in Vietnam to protect the CIA’s heroin trafficking in Laos and we were going into massive debt. The French had lost the French Indochina wars and were in debt themselves. So De Gaulle wisely started demanding gold instead of U.S. treasuries. The U.S. gold supply was rapidly diminishing to pay for the war, so we ended the gold standard. We’ve been an entirely fiat debt system worldwide ever since.

More from Vongreyerz Gold:

Global actors (including the BIS) are openly preferring real gold (i.e., sound money) as a strategic reserve asset over USTs for all the obvious reasons, namely: Who wants/trusts an IOU (a declining asset) from an over-indebted issuer (Uncle Sam) who is also prone to weaponizing (i.e., stealing) that asset?

The entire world is being FORCED back to “sound money” and I don’t believe that’s a coincidence. This is why Trump doesn’t talk about cutting spending, but is actually increasing government spending. This makes U.S. treasuries, which are fiat IOU’s, less attractive and also forces the FED to eat more debt (U.S. treasuries) to keep the entire system afloat.

Trump is bankrupting the entire system and FORCING the world back to a gold standard.

More from Vongreyerz Gold:

Ultimately, global gold demand is rising, and gold supply (in the banks, COMEX, etc.) is tightening—all of which is extremely good for gold.

Of course, all of these moving parts flows, and figures boil down to a simple bottom line that no one in the halls of any government, bank or financial MSM outlet wants to say out loud: There’s no way out of this historical debt trap.

The global financial system is broken.

Too Broke to Grow

The debt-soaked US (at 125% debt to GD), like so many other nations, is mathematically too broke to grow.

Uncle Sam, caught in this debt trap, has only 3 bad options to select from: 1) default on the debt, 2) discover a productivity miracle, or 3) inflate or die.

Option 1 won’t happen with a money printer in the corner; option 2 can’t happen once debt to GDP crosses 100%, and option 3 now just becomes a matter of time and the right headline event.

We are rapidly reaching the historical end to this worldwide fiat debt system. I think it has all been planned and timed, so that Trump can move us into the new system which will give the people true financial freedom for the first time in our lives.

How big is the transformation that is about to occur?

More from Vongreyerz Gold:

Today, this debt crisis is global and unprecedented.

As such, demand for physical gold, as evidenced by the BRICS+ maneuvers and now clearly demonstrated by the COMEX inflows and outflows above, is equally global and unprecedented.

In a world racing toward $400T in entirely abstract global debt (which is 2/3 higher than global GDP), there is less interest (but greater distrust for) sovereign debt instruments and debased fiat money within a fractured banking and financial system, the open cracks of which we have been tracking/warning for years.

The endgame approaches and the one true money in the world isn’t even on most people’s radar.

More from Vongreyerz Gold:

Although this should be obvious to literally everyone, almost no one understands gold (it accounts for less than .5% of global financial allocations).

But as we’ve warned for years, the broken, centralized DC system (as well as the RIA’s and the PWM teams of the TBTF banks) that controls your money (and media) doesn’t want you to understand this, as rising gold prices are proof of a declining nation, currency system and “safe” banking narrative.

Again, this should be obvious to everyone. The evidence is almost too simple.

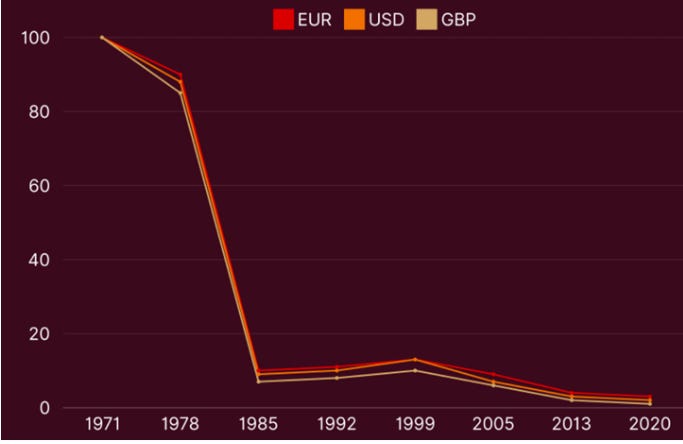

When measured against a milligram of gold, all fiat money has lost greater than 99% of its purchasing power since the USD decoupled from gold in 1971.

More from Vongreyerz Gold:

A 400-ounce bar of gold sold for $17,000 in 1971; today, the same bar sells for $1.14M.

Hmmm… See a currency problem?

Do you also see why the world’s traders, central bankers, mega-institutions and nations are increasingly seeking physical, allocated gold outside the banking and COMEX system to be held exclusively, physically and fully segregated in their own name—a practice and service we’ve been engaged in for decades in Switzerland?

Pet Rock? Really?

Or do you still think gold is just an outdated, analog pet rock poised to fall before all things modern, digital and “tech-evolutionary”?

This huge shift in gold accumulation by major players is a an eye opening development.

But silver is the real canary in the coal mine. While the price of gold has been rising, silver hasn’t even begun to take off yet.

As a matter of fact, it is poised for a big move.

According to Zerohedge:

https://www.zerohedge.com/precious-metals/gold-silver-ratio-silver-breakout-incoming

Gold-Silver Ratio: Silver Breakout Incoming?

Gold has reached new all-time highs, and the gold-to-silver ratio now exceeds 90:1.

Such a high ratio has often signaled an impending breakout for silver prices. It indicates that silver could be undervalued, and we may be on the verge of a major price surge. Sometimes, if you miss a price run-up for gold, you can make up for it by buying silver instead as it catches up to its yellow cousin.

There is another reason to believe that silver is getting near its major breakout.

There is a clear chart pattern that is forming that always signals a major breakout.

According to Zerohedge:

https://www.zerohedge.com/news/2025-01-27/we-are-witnessing-prelude-biggest-baddest-short-squeeze-history-markets

We are Witnessing A Prelude to the Biggest, Baddest Silver Squeeze

Silver May Not be Your Cup of Tea…

But the Charts are most certainly showing a Textbook Cup (& Handle)

While the financial news stations focus most of their attention on the stock market, it seems as though the precious metals market is beginning to garner more of the headlines lately, especially after gold broke out to a new all-time high last Friday.

History does not repeat itself exactly, but in the world of technical analysis, patterns most definitely repeat. In fact, one of the most reliable price patterns is the textbook Cup & Handle formation. Below you will see a 55-year monthly chart of silver, highlighting the pattern I am referring to.

More from Zerohedge:

Silver has a long way to go just to test the brim of the cup, however, a breakout over $50 is when the real action begins.

Keep in mind, I am not factoring in the supply shortage we are already seeing due to the industrial applications of this precious metal, so we could wind up in unchartered territory once the short squeeze begins.

COMEX is Most Vulnerable

COMEX, which is part of the CME Group, the world’s leading derivatives marketplace, is extremely vulnerable to a short squeeze because they are the exchange that is obligated to deliver the physical metal to those who take delivery on the expired futures contracts. Once we have reached a point, where the supply runs out, the global exchanges will have to, as some say, ‘beg, borrow, or steal’ the silver bars to meet their delivery obligations. If there isn’t enough silver to fulfill their delivery obligations, COMEX could wind up in default. Needless to say, this would result in an unprecedented global catastrophe that would also take out the banks who are involved with lease agreements in Silver.

Can you see the vulnerability for BOA or any other big bank that is “shorting” silver?

Silver always lags gold’s moves and right now there is a mad rush for COMEX traders to take physical possession of their gold trades. That is driving up the gold price to record prices because gold has already broken above its cup and handle pattern.

Silver is getting closer to doing the same thing and that will bankrupt the banks that are shorting silver.

As of today, silver is over $32 and on its way to $36. I believe that is the biggest resistance level that these banks are desperately trying to keep it from penetrating. There isn’t much resistance on the way to $50. The all time high for silver is just under $50. That is the price when silver will break fast to the upside, as it breaks above the cup and handle pattern.

I believe these banks that are shorting silver are already billions in the hole. If the silver price breaks $36, I think we’re going to see another bank run and this one will be bigger than the ones we’ve seen over the last six years or so.

The domino effect of these big banks are going to put a lot of pressure on the FED and I believe the days of taxpayers bailing out big crooked banks are over.

Either the FED will eat the bad debt from these banks, which will lead to their bankruptcy, or Trump will nationalize them. Maybe both.

I’m just guessing how all of this will play out because I’m not an insider. But the signs of this event are incoming and silver seems to be the key to watch.

I think the silver price will be the catalyst that gets the ball rolling on ending the worldwide financial debt system, so that we can finally move into a new system that provides financial freedom with many safeguards to preserve it.

The best is yet to come!

Great article Joe!

As someone who owns actual physical ("physical ETF" is an oxymoron) and have been watching these manipulated markets for decades now, I wish I could express just how long I've been waiting for this. Every weekend the metals prices would be monkey-hammered back down, especially silver. It was hard watching retail investing in metals ETFs too, thinking they could "take delivery" someday. If your gold isn't in your hand, you don't really own it.

I've always tried to tell people "It's not that gold is worth more, it's the dollar losing value." All along my primary goal was to just try to maintain the value of my savings: to not LOSE it. I knew I was in it for the long haul, and it has been a very, very long one.

I still didn't know that Bear Stearns was the largest short out there though, that's interesting. JPM was known to be shorting the silver market themselves even before 2008, and people were trying to guess as to how much influence they had - so I guess JPM didn't let that crisis go to waste. I've been following ZH since they started, sometime around 2006 I think - they're great.

So wow, now Trump is repatriating gold... he's taking away the City of London's chokehold. BRICS countries have been stockpiling gold for years, and this scramble here in the U.S. is the rumble before the earthquake then.

I'm not so sure those white hats didn't take over JPMorgan back in 2019 and then force BoA to hang their ass in the breeze though, giving them control over both banks. Infiltration, and all that.

But either way, all these fractional reserve lending banks deserve everything they are going to get. Gold may end the Fed, but perhaps silver will end the big banks. Those derivatives unwinding could take them all down like dominoes, and because everything is flash-traded now, their network will fail just like computer networks always do: all at once.

It's going to be fascinating to see what happens when they go to audit Fort Knox, too. (I can't even think of the name "Fort Knox" without automatically thinking "tungsten" though.)

Thanks for another great take!

A Joe Lange article…. Day made!!!